Unlock precision risk insights for trading desks and quant strategies

The Axioma Equity Factor Risk Models: Trading Horizon delivers precise portfolio risk exposures and forecasts for ultra-short investment horizons when the markets move abruptly and sharply change direction.

Available in two variants:

US Trading Horizon (US5.1-TH)

Download factsheetWorldwide Trading Horizon (WW5.1-TH)

DOWNLOAD FACTSHEETWhy Trading Horizon Models?

GridTeaserElement

JSS component is missing React implementation. See the developer console for more information.

GridTeaserElement

JSS component is missing React implementation. See the developer console for more information.

GridTeaserElement

JSS component is missing React implementation. See the developer console for more information.

GridTeaserElement

JSS component is missing React implementation. See the developer console for more information.

Who is the Trading Model for?

New factors in Version 5.1 vs previous version (4.0)

- Short Interest: Risk and return impact based on how heavily a stock is shorted

- Opinion Divergence: Measures lack of consensus among investors based on unusual trading volume

- Downside Risk: Captures negative or uncompensated risk including downside volatility and recent maximum returns

- Investment: Measures asset growth, sales growth, and inventory growth

- Non-linear Residual Structure: Finds higher-order explanatory factors in residual returns to capture hidden risk exposures

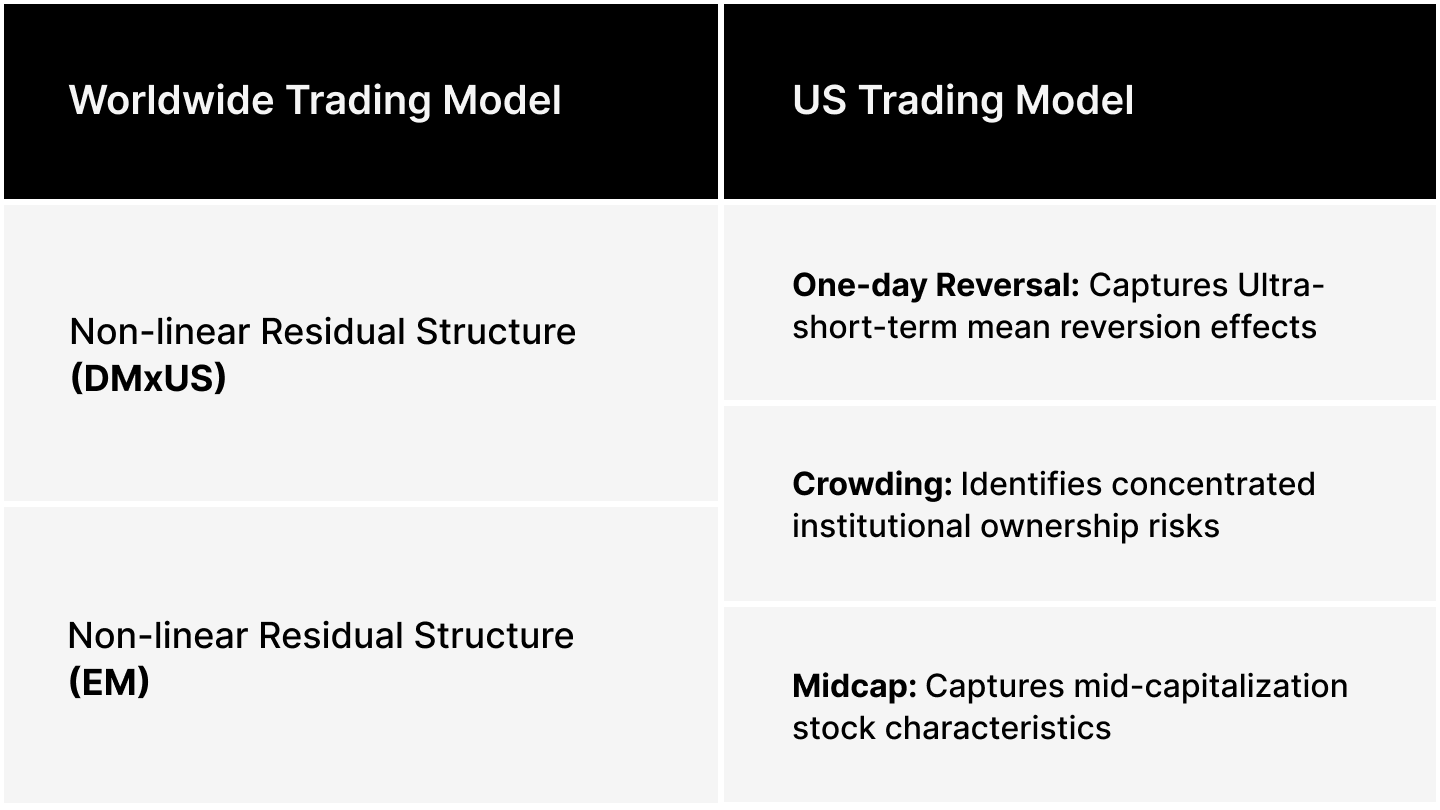

Worldwide vs US Trading Model (v5.1)

Tabs

JSS component is missing React implementation. See the developer console for more information.

Related products

Axioma Equity Factor Risk Models

Flexible and intuitive equity risk models backed by proprietary research

Axioma Portfolio Optimizer

Advanced portfolio construction software for research and analysis

Axioma Risk

Cloud-native, SaaS risk management solution for a single, consistent view of risk

Contact us

Related Content